Excise Tax 2023

As of January 1, 2023, a new excise tax has been implemented on vaping products in Canada. This tax is being implemented at the federal level and applies to all vape products, including electronic cigarettes, e-liquids, and other vapor products.

There has been a new excise tax implemented in Canada. This excise tax on vaping products is known as the federal Excise Duty on Tobacco Products and is administered by the Canada Revenue Agency (CRA).

An excise tax is a tax that is levied on the production, sale, or use of a specific good or service.

This tax is being implemented through the introduction of a new excise duty framework. The duty applies to all vaping related e-liquids that are manufactured in Canada or imported and that are intended for use in a vaping device in Canada, as well as any vaping related items. Excise taxes are also a popular policy tool used by governments around the world to discourage the consumption of products that are perceived to be harmful to individuals or society.

This tax is applied to the taxable amount of e-liquid, which is the wholesale price of the e-liquid plus any applicable markups, minus any applicable discounts or rebates. The taxable amount is determined at the time the e-liquid is delivered to the purchaser. This tax is also intended to discourage the use of e-cigarettes and other vaping products, particularly among young people.

E-cigarettes and other vaping products have become increasingly popular in recent years, with many people turning to them as a way to quit smoking traditional cigarettes.

This new tax has been the topic of being very controversial since it has been implemented. Let's explore some of the reasons why.

One of the pros people see with the excise tax, is that it may be seen as a positive step in reducing the use of these products. However some people argue that the tax disproportionately affects low-income individuals, who may be more likely to use e-cigarettes as a cheaper alternative to smoking.

There is also concern that the excise tax may not effectively discourage the use of e-cigarettes, as it may simply drive people to purchase these products from unregulated sources or on the black market.

Another issue that may arise is the excise tax may not effectively address the negative externalities associated with the product. For example, if the excise tax is intended to reduce smoking rates to reduce the burden on the healthcare system, it may not be effective if people continue to smoke despite the higher price.

And finally, the excise tax may not be a sustainable source of revenue in the long term, as people may reduce their consumption of the taxed product or switch to substitutes, leading to declining tax revenues.

Overall, the excise tax on vaping products is a controversial issue that raises a number of complex questions about public health, personal choice, and the role of government in regulating consumer behavior. While the tax may be "well-intentioned", it is important to carefully consider the potential consequences and ensure that any policy decisions are made with the best interests of the public in mind.

We must constantly voice our concerns with illogical legislation; if legislation and taxes are intended to be positive for society, there should be facts and logic to back all decision. To charge a Sin tax on a product that has no demonstrable harms is illogical and unfair.

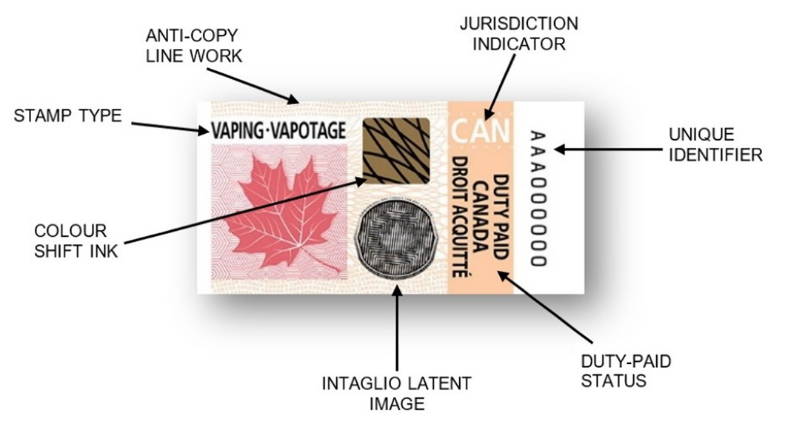

Vaping products that are subject to the excise tax must bear an excise stamp that indicates that the tax has been paid. The excise stamp must be affixed to the packaging of the vaping product in a manner that is specified by the CRA. The excise stamp must also include certain information, such as the date of manufacture, the name and address of the manufacturer, and the type and quantity of the product.

In addition to the excise tax, vaping products may also be subject to other taxes and fees in Canada, such as the goods and services tax (GST) and the harmonized sales tax (HST).

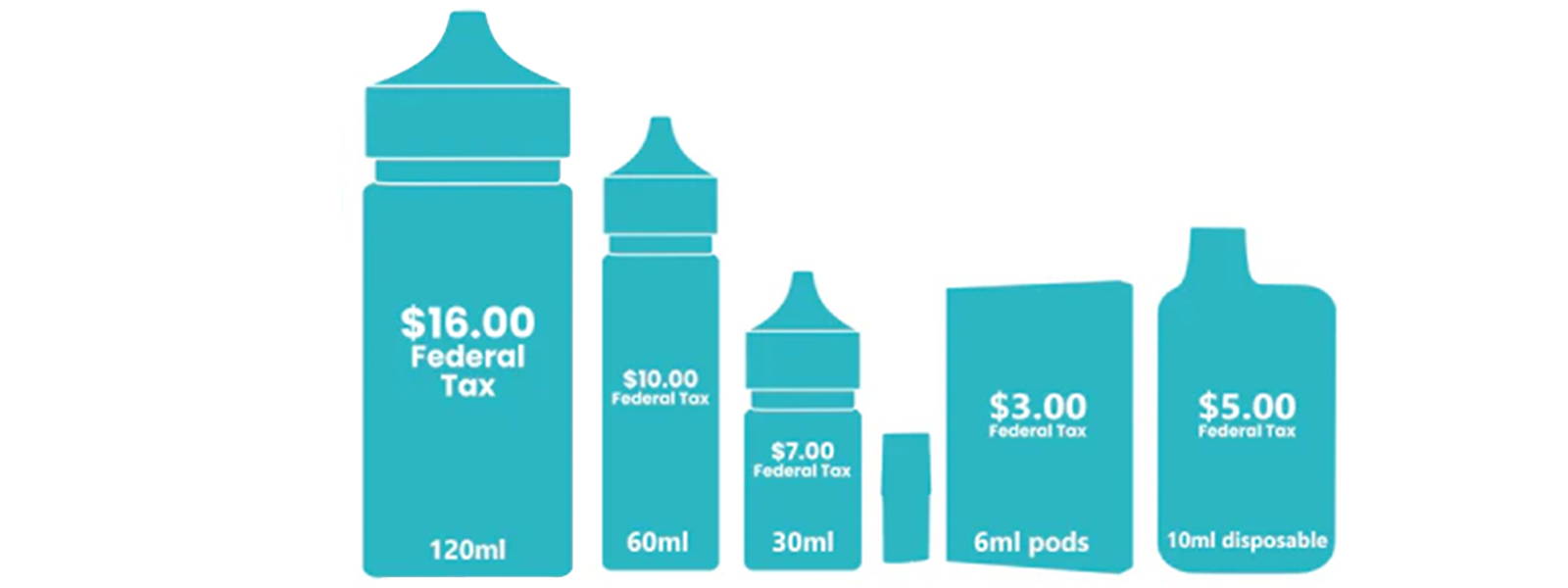

For the first 10mL of liquid the duty is $1.00 per 2mL. For each additional 10mL of liquid the duty is at the rate of $1.00 per 10mL

Disposable/Pods

Less than 2 ml = $1

2-4 ml = $2

4-6 ml = $3

6-8 ml = $4

8-10 ml = $5

If there are multiple containers in the package (multiple pods/devices in a pack), the duty is individually applied to each unit

Juice

10mL = $5.00

30mL = $7.00

60mL = $10.00

120mL = $16.00